DCDC

Delaware Economic Development CorpDCDC

Small Business Owners

The 504 program provides financing for facilities and equipment for expanding small businesses. The terms of a 504 loan are not available to small business using conventional financing. By combining a lender sourced loan (50%) and a loan from DCDC (40%) the small business receives a balanced loan package that supports business expansion and job creation.

Primary Advantages

90% Financing preserves working capital and supports the expansion of the small business. The lack of working capital is a significant road block to the expansion of business.

Twenty and twenty-five year fully amortizing loans match the loan term and useful life of the real estate assets. This allows businesses to retain cash for business operations.

Competitive fixed rates on the twenty and twenty five year loans allows the small business to have set occupancy costs. This allows the owner to concentrate on the business expansion.

Community Impact

Jobs

An expanding small business creates new jobs in the community.

revenue

Tax revenue increases from job related taxes and an expansion of the real estate tax base.

expansion

The small business expansion is supported by the 504 loan. The small business becomes an economic growth engine for the community.

Frequently Asked Questions – Program

Who makes the 504 Loan?

A lender (50%) and a Certified Development Company (CDC) (40%) make the 504 loan.

A certified development company like DCDC, is a non-profit organization certified and regulated by the U.S. small business administration.

The job of the CDC is to facilitate the 504 loan from beginning to end.

What can a 504 loan be used to finance?

A 504 project can be used to finance the purchase of land, building, and equipment. This includes improvement to the building, soft cost ¹ related to the purchase and improvements, ¹ and professional fees.

The 504 program also allows for the refinancing of debt used to acquire real estate and equipment.

How much can be borrowed using a 504 loan?

The minimum size for a 504 project is $125,000. This results in a $50,000 504 loan. On the other end the maximum size is $5MM or $5.5MM if for a manufacturer or energy efficient projects. There is no limit on the size of the lenders loan.

What is an energy efficient project?

An energy efficient project is either a project that includes a new facility replacing an existing facility or renovation of an existing facility. The project must result in the reduction of energy consumption by at least 10%.

An energy efficient project can also by used for plant, equipment, and process upgrades of renewable sources used to run the facility or for renewable energy producers. The projects must generate more then 15% of the energy needed for the facility.

A 504 energy efficient project loan can go up to $5.5MM per project portion and up to $16.5MM in aggregate financing.

Can the 504 loan be paid off early?

¹ No partial prepayments are permitted but full prepayments are permitted. In the first 10 years of the loan there is a penalty for early payment. The penalty declines by 10% annually.

How long will it take to approve the 504 loan request?

DCDC requires ten to fifteen days to secure approval from its loan committee and the SBA once it receives a commitment letter from the lender. Once approved by the SBA you will receive a debenture authorization which outlines the terms of the 504 loan.

Is a 504 loan assumable?

If the small business is selling the building, a qualified purchaser may assume the 504 loan. There is a $1,000 fee to assume the loan and prepayment penalties do not apply.

Recent Projects

Lefty’s Alley & Eats

Lefty’s Alley & Eats, a Rehoboth Beach Family Entertainment Center was a ground up construction project involving a special purpose property (bowling alley) which added 5% to the equity requirement and a start-up business which also added 5% to the equity requirement. The project was completed in November 2016.

La Fia

An artisan bakery, bistro, and market located in Downtown Wilmington at 421 Market Street. This WEDCO loan for was provided for the purpose of assisting in an inventory system, working capital, and furniture.

Nurse Next Door

Mom and Dad deserve the best. To find a perfect match, each Nurse Next Door caregiver is carefully screened, interviewed, and selected not only for experience, but their passion for making a difference.

Lenders

Do you have a small business client that is considering the purchase of a building or capital equipment?

Will this put a squeeze on their working capital or limit your ability to provide additional products or services that will expand your business relationship?

If so, a 504 loan may be just what you and your small business client need.

504 loan advantages if you are a…

Small Business

- Conserve working capital with up to 90% financing of all project costs.

- Below market fixed rates on loans of 10, 20, or 25 years which are fully amortizing.

Lender

- Make a loan secured by real estate.

- Possible CRA credit.

- Make loans to industries that you might usually steer clear of.

Real Estate Broker

- Expand the number of potential buyers.

- Increase your number of sales.

- Add another tool to help meet your clients needs.

Loan Package

The items needed by DCDC to obtain approval are essentially the same as the items needed by any commercial lender.

- 3 years business tax returns projections if historical cash flow does not provide adequate debt coverage.

- Personal tax returns and financial statements for all owners.

- Contract to purchase land and building and renovation estimates.

With a complete package DCDC is able to obtain approval in 10 to 15 days, depending on the complexity of the project, following the lender’s commitment.

Eligible Costs

Capital equipment with long useful life and owner occupied commercial real estate are eligible to be financed using a 504 loan. If it is an existing building with owner must occupy 51% of the building or 60% if it is new construction.

If improvements or renovations are needed to be done these can be included as new construction. Soft cost and professional fees may also be included in the total project.

If the small business has existing debt on their facilities this can be refinanced using a 504 loan.

Frequently Asked Questions – Application

How much of a down payment is required?

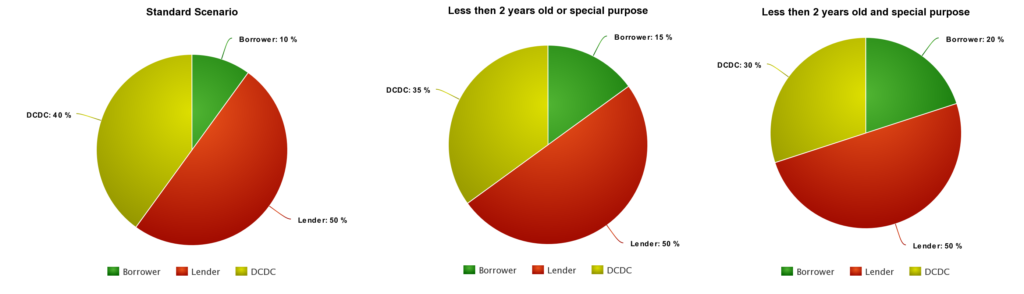

Once the total project costs are determined the borrower is required to inject 10% as a down payment. The lender provides 50% and DCDC 40%.

If the small business is less then two years old OR the property is considered a special purpose property the equity injection increases to 15%, the lender stays at 50% and DCDC drops down to 35%.

If the small business is less then two years old AND the property is considered a special purpose property the equity injection increases to 20%, the lender stays at 50% and DCDC drops down to 30%.

What small businesses are eligible for a 504 loan?

For project corp, partnerships, proprietorships whose net worth does not exceed $15MM and after tax profits average less than $5MM during previous 2 years.

Are non-profit companies eligible for a 504 loan?

No. Non-profit entities are not eligible for a 504 loan. Lenders, investment companies, rental property owned with the primary intention of sale, investment, or speculation are not eligible for a 504 loan.

Are appraisals required for a 504 loan?

Yes. The appraisal may not be restricted in any manner. It must use at least two valuation methods. The appraisal must also be addressed to and include as intended use Delaware Community Development Corp and U.S. Small Business Administration.

The appraiser must meet certain qualifications and the report may need to meet certain industry standards.

Projects involving construction or renovations will require a letter from the appraiser or an architect to state that the project was completed according to plans.

Is an environmental report required?

Yes. The type of report depends on the history of the property. The report may be as simple as a record search risk assessment (RSRA) or as extensive as a phase 1 no contamination can be present.

Does the small business have to create jobs as a requirement of the 504 loan?

Yes. The SBA requires the small business to create jobs over the first two years following the completion of the project. The number depends on type of business and loan size. The SBA allows the small business to meet other economic development criteria if it cannot meet the job creation criteria.

Is there a minimum project size?

The minimum project size is $125,000.

What can refinanced in the 504 program?

To be eligible for refinancing the loan must:

- Be at least two years old.

- 85% of the proceeds must have been used for R/E or equipment OR 51% of the property is occupied by the small business.

- The loan cannot be federal debt.

Existing Borrowers

Approval of the 504 loan is just the first step in a long term relationship. We are committed to to providing you the very best customer service and are here to help you with your servicing needs.

Closing FAQ’s

What are the requirements to fund my 504 loan?

The SBA Debenture Authorization list the requirements to fund the loan. All documents requested by DCDC must be provided and reviewed by the DCDC closing counsel. When the closing counsel determines that all requirements have been met DCDC is able to submit the loan for funding.

What are the insurance requirements for the 504 loan?

Adequate insurance coverage is required for the life of the loan. This is covered in section E1 insurance requirements in the authorization.

The most common insurance requirement is Real Estate Hazard Insurance.

DCDC Board of Directors

Janet Dougherty, President

Fulton Bank, N.A.

Stanley F. Soja, Jr., Secretary

Wilmington Parking Authority

Heath N. Kahrs, CPA, Treasurer

Santora CPA Group

Mark Brindle

Chase

Robert E. Bunting

M&T Bank

Jeff Flynn

City of Wilmington

Michael Hahn

44 Business Capital LLC

Willie F. Henry, Jr.

Advancing Strategic Innovations, LLC

Frederick H. Mitsdarfer, III

Richards, Layton & Finger

Donna Murray

State of Delaware

Robert A. Rausch

Get In Touch

WEDCO

100 W. 10TH STREET, SUITE 214

WILMINGTON, DE 19801

PHONE: (302) 571-9088

FAX: (302) 652-5679

INFO@WEDCO.ORG